With the post-Covid property selling boom having waned to more familiar market conditions, and the recent end of the Help to Buy Equity Loan, buyers might need a different buying boost. Shared Ownership offerings are an ideal way for house builders to tap into a wider customer market, taking advantage of a scheme that makes home ownership more affordable for many.

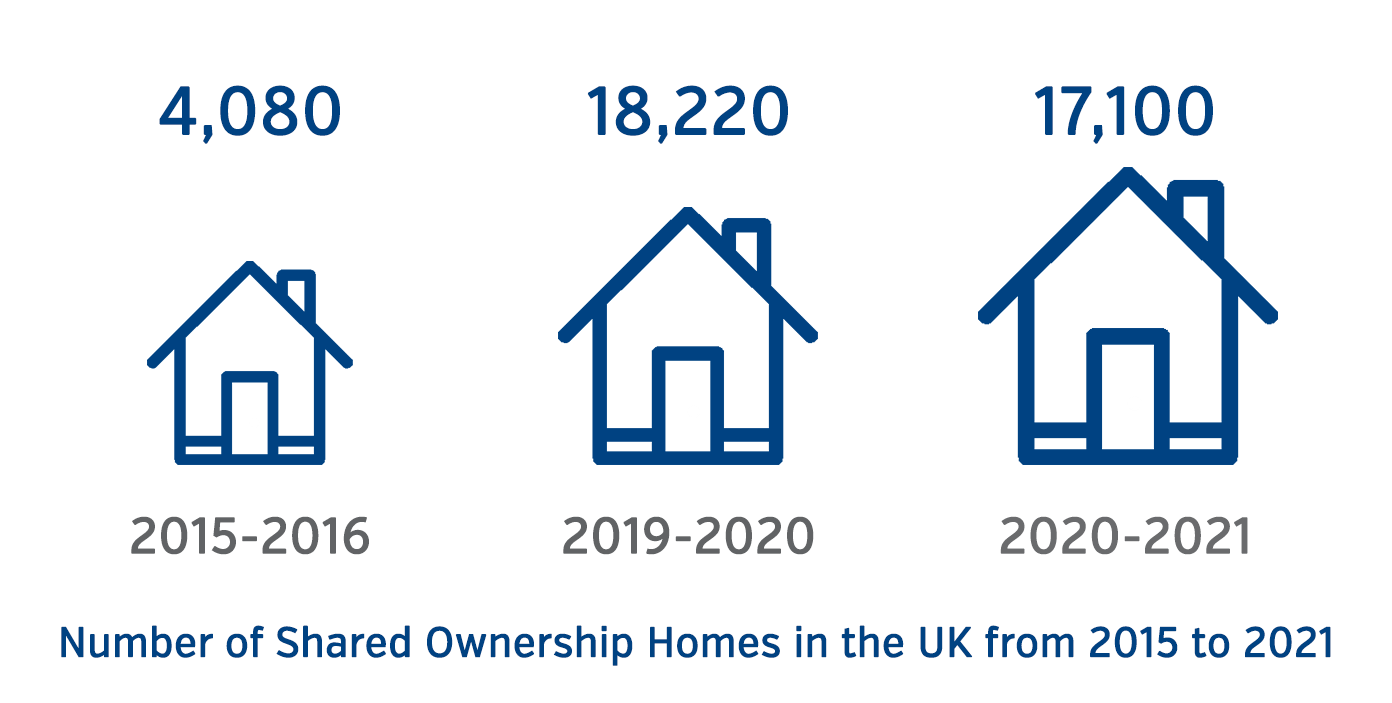

Shared ownership has been increasing over the last few years, whilst only 4,080 units were completed in the year 2015-16, in the past three recorded years the number of Shared Ownership homes built has more than quadrupled. 18,220 were completed in 2019-20, 17,100 in 2020-21 and 19,386 in 2021-22.

As of December 2021, there is now 202,000 households in the sector in England, and whilst this is progress, it represents less than 1% of households. A tiny minority of households have been able to begin creating a long-term home without the massive financial outlay, however it is still 'out of reach' for many. In 2021-22 only 76% of these buyers were First Time Buyers, demonstrating how Shared Ownership is a scheme more open for use than the Help to Buy Scheme ever was, widening the pool of potential buyers. Shared Ownership can be a great option for First Time Buyers, but also for people who have experienced financial and relationship breakdown, single parents/families, disabled people who need an accessible home, and people who need help ‘rightsizing’.”

The major difference between shared ownership and help to buy, besides even more accessible financial thresholds and a wider customer base, is that shared ownership is establishing a longer term commitment for buyers. Shared ownership schemes demand a longer process than simply buying a property and paying back loans, buyers are renting alongside paying their mortgage, doing so means they are committing to being in their home in the long term, in order to staircase their shares upwards.

Long term commitments can sound scary, but the reality is, this commitment is positive; the security of home ownership is based on commitment. The demand for homes is not going to abate anytime soon, but shared ownership allows people to commit to buying and renting a home with a future in mind. Commitment is good for developers too, because it sees houses become homes, people commit to live in new developments for the long term, transforming them into communities. Shared ownership allows developers to service a first time buyer market that is increasingly hard to reach, and pushes houses towards people that will make them into homes. With the rapidly changing financial and political world, it has become even more important to work collaboratively with a financial service you can trust. Mortgages First and RSC help keep customers and clients updated and reassured during these uncertain times.

The New Build Development Director of Mortgages First & RSC, Andrew Mannion explained how RSC and Mortgages First can help housebuilders benefit with the SO scheme on their development;

Customers can start their mortgage journey by utilising our Mortgage Match facility to obtain affordability and credit decisions for shared ownership mortgages in just 60 seconds''.

To find out how Shared Ownership can help you, your development and your buyers, get in touch with The SO Hub. Our expert advisors can help create a bespoke plan for your development.

The SO Hub

0115 671 0397

www.lsllandandnewhomes.co.uk

For Mortgage advise

Mortgages First

01206 731 800

www.mortgages-first.co.uk

RSC

0161 486 6278

www.rscnewhomes.com

Sources

-

Gov.UK - Shared Ownership Homes: buying, improving and selling

-

House of Commons Library - Shared Ownership (England): the fourt tenure?

-

Gov.UK - National Statistics: Social housing sales and demolitions 2021-22

Our experienced land & new homes experts can provide you with the knowledge & expertise that you need.