It’s a new year, and if you read our wish list back in December, you’ll see we had high hopes for what the housing industry would like to see going into 2025 and onwards. Now, in the sober light of January we look instead to the reality of what we can expect for the year ahead. The economic outlook is positive overall, whilst buyer demand looks good for now but could take a hit in March. This year will largely hinge on the government's ability to implement real changes to stimulate building, whilst shared ownership could play a crucial role in addressing ongoing affordability challenges.

Continued Market Recovery

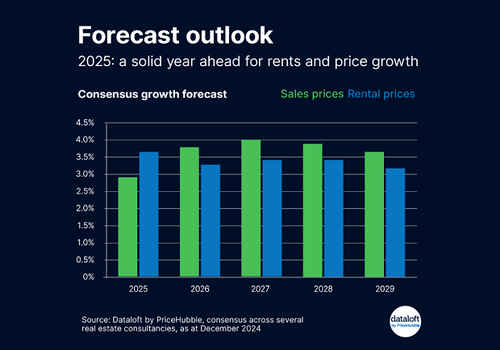

2024 saw a recovery for the housing market that was better than many expected after faltering in 2023, this unexpected resilience saw average sold prices increasing by up to 4.7% according to some estimates. It is expected that 2025 will see a continuation of this trend as interest rates are cut throughout the year and ease mortgage pressures. Whilst the Autumn Budget did not offer a fast track to recovery, there are healthy projections that house prices might increase by about 3% this year.

Buyer Demand

Another encouraging sign is that Rightmove saw their busiest Boxing Day ever with 26% more new properties listed and enquiries 20% higher than the previous year on this notoriously busy day. Buyers have adjusted to the reality of current mortgage rates and sales have become easier, reducing time to sell by 6 days over 2024. Another reason for growing demand could be the predicted rush we will see in the first months of the year before the stamp duty changes take effect in March. Many are predicting that buyer demand will fall after this threshold, and that prime market buyers will be the hardest hit, it remains to be seen whether a stronger market will withstand the change.

Government Follow-through

After 6 months in power we have some ideas of what to expect from the government on the housing industry, based on their first months in power and the Autumn Budget. We have seen commitments and consultations, but 2025 should be the year we see some significant legislative changes. The Planning and Infrastructure Bill mentioned in the Kings Speech has yet to be fully introduced, whilst we also await further details on devolution, new towns, funding allocation and more. The coming months will be crucial for establishing whether the 1.5 million new homes objective, necessitating a 61% increase in homes built this year, is achievable.

Opportunities for Shared Ownership

Affordability of homes will continue to be a pressure on buyers in 2025, and with the government not currently signalling any new buying schemes, shared ownership could be key. Whilst only 3% of homeowners in the 2021 census were in shared ownership homes, the tenure has continued to steadily grow over the last few years. Now, with ambitious housing targets in place, shared ownership will be essential to securing sales for new homes being built. When building homes, developers need to know they can sell them and move on to their next development, and by expanding the market of potential buyers, shared ownership can significantly enhance absorption rates.

2025 could be a big year for the new homes industry, as the market continues to recover, and we see the implication of some of the governments ambitious plans. Despite challenges from the slow nature of economic improvement and an expected hit to buyer demand, there is opportunity on the horizon. Planning reforms could unlock development opportunities across the country, and shared ownership might become an even more significant option for securing housebuilders sales, and buyers homes. Here’s to hoping opportunities are grabbed and we ultimately look at 2025 as the beginning of a housebuilding boom.

If you have plans you’re looking to get off the ground in 2025 get in touch with our experts sales and marketing team, and our colleagues at The SO Hub.

Our experienced land & new homes experts can provide you with the knowledge & expertise that you need.