The Help to Buy Equity Loan scheme is coming to an end, and with no new help to buy schemes expected, this could be the last chance buyers and developers have to take advantage. The Equity Loan extends the option to buy a home, to people who would fall short without, and with soaring interest rates, following some record growth in house prices, the proportion of first time buyers who fall into this group will only have increased.

A scheme that’s good for buyers is generally good for developers too, by widening the prospective buyers’ market, the equity loan scheme increases the demand and sales rate for new homes.

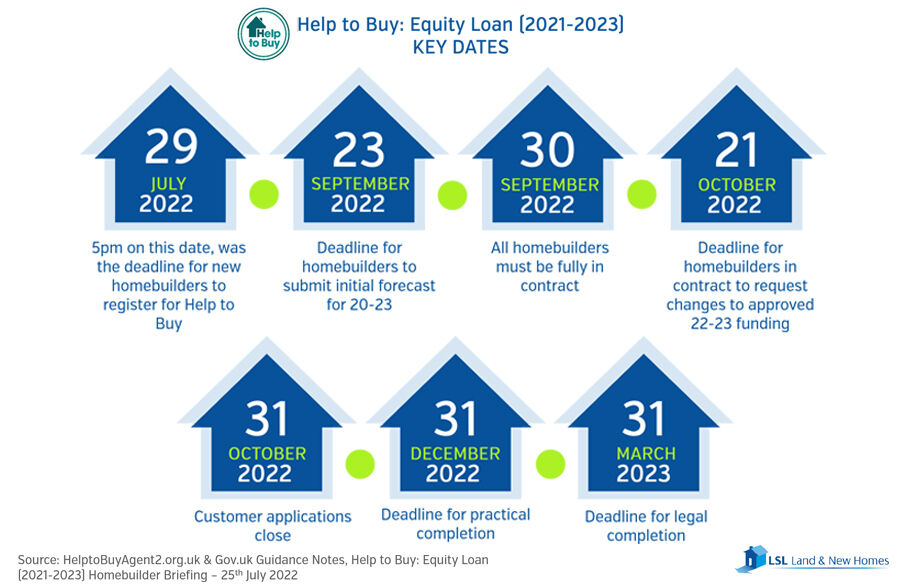

The deadline for customer applications to buy through the scheme is 31st October, leaving just over 2 months for developers to reach those buyers, eligible for the scheme, who should take the chance now to get onto the property ladder. The scheme allows for purchases to a maximum price that is consistently higher than the average price paid by first time buyers in 2021. In fact, in the south east the maximum purchase price is more than 50% higher than the average. This goes to show just how much of an advantage this could be for first time buyers, allowing them to stretch their affordability to invest in homes for the long term.

|

Region |

Maximum property purchase price |

Average purchase price for first time buyers 2021 |

Difference |

|

North East |

£186,100 |

£130,956 |

£55,144 |

|

North West |

£224,400 |

£169,256 |

£55,144 |

|

Yorkshire and the Humber |

£228,100 |

£168,506 |

£59,594 |

|

East Midlands |

£261,900 |

£248,951 |

£12,949 |

|

West Midlands |

£255,600 |

£192,979 |

£62,621 |

|

East of England |

£407,400 |

£268,568 |

£138,832 |

|

London |

£600,000 |

£440,590 |

£159,410 |

|

South East |

£437,600 |

£286,716 |

£150,884 |

|

South West |

£349,000 |

245,336 |

£103,664 |

As we see mortgage rates rise, buyers’ affordability is set to suffer, before we see the ramifications of this play out for the sector, taking full advantage of the equity loan is advisable. Keep the 31st October date in mind, and help first time buyers into their first home before the opportunity is missed.

LSL L&NH have registered eligible active buyers, looking for developments offering this scheme on their new build homes. Let us help you connect with these buyers.

Call 0845 340 2940 or

Contact us today to find out more

Sources: Direct Line Group, Gov UK, Office for National Statistics.

Our experienced land & new homes experts can provide you with the knowledge & expertise that you need.