With the UK housing stock worth an estimated £7.14 trillion the housing market remains a powerful player within the UK economy. Despite political and economic volatilities the overall value of the UK properties has risen by more than a third over the last decade. So with a jittery stock market and low interest rates property is still seen by many as a secure investment.

With the UK housing stock worth an estimated £7.14 trillion the housing market remains a powerful player within the UK economy. Despite political and economic volatilities the overall value of the UK properties has risen by more than a third over the last decade. So with a jittery stock market and low interest rates property is still seen by many as a secure investment.

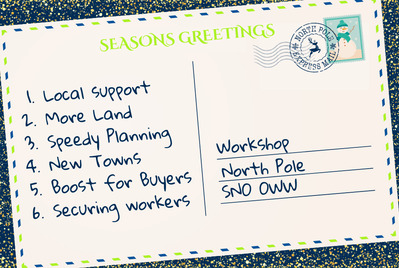

However, prices have been increasing year on year in part because of a lack of supply and an insatiable level of demand potential from first time buyers and investors. To address this imbalance between supply and demand a number of solutions have been proposed.

1 Build more new homes

The most obvious solution is to simply build more new homes. Recently the Government announced that it wants to deliver 300,000 new homes per year by the mid-2020s. Given the challenges faced by the construction industry such as labour and material shortages, this may be a difficult target to achieve.

The most obvious solution is to simply build more new homes. Recently the Government announced that it wants to deliver 300,000 new homes per year by the mid-2020s. Given the challenges faced by the construction industry such as labour and material shortages, this may be a difficult target to achieve.

In a survey by the Federation of Master Builders 54% of small to medium sized developers viewed accessing funds as being a barrier to them building even more new homes. Measures announced in the *Autumn budget of 2017 sought to address this issue by making £8 billion available to fund financial guarantees, particularly to support the purpose-built private-rented-sector.

2 Planning reform

Successive rounds of changes have substantially relaxed planning laws and streamlined planning processes. In high demand metropolitan areas such as Birmingham, Manchester and London planning applicants are now encouraged to extend upwards. This has a double benefit of increasing the number of larger homes, as well as increasing the number of rented units available.

Successive rounds of changes have substantially relaxed planning laws and streamlined planning processes. In high demand metropolitan areas such as Birmingham, Manchester and London planning applicants are now encouraged to extend upwards. This has a double benefit of increasing the number of larger homes, as well as increasing the number of rented units available.

To facilitate a step change, newly created New Town Development Corporations will kick-start the development of five new garden towns. For example, the Cambridge / Milton Keynes corridor will see 1 million new homes by 2050.

3 Change of use

Following a relaxation of the planning rules, office blocks and former industrial units are increasingly being converted into apartments and flats; Battersea Power Station being a well-known example. This releases large numbers of units into the market relatively quickly and allows business to move to more modern premises elsewhere.

Following a relaxation of the planning rules, office blocks and former industrial units are increasingly being converted into apartments and flats; Battersea Power Station being a well-known example. This releases large numbers of units into the market relatively quickly and allows business to move to more modern premises elsewhere.

In areas where office space is at a premium this strategy will tend to make matters worse by eroding the availability of available office space. Planning departments in these areas would have to be careful to preserve a balance between different use types.

4 Renovation and regeneration

A relatively rapid solution may be to renovate derelict properties. It is estimated that more than 216,000 properties have been unoccupied for more the 6 months and 11,000 homes have been empty for a decade or more. Many will require substantial renovation and modernisation to make them habitable, or demolition and replacement with a new build home.

A relatively rapid solution may be to renovate derelict properties. It is estimated that more than 216,000 properties have been unoccupied for more the 6 months and 11,000 homes have been empty for a decade or more. Many will require substantial renovation and modernisation to make them habitable, or demolition and replacement with a new build home.

To maximise the use existing properties councils now charge a 100% tax premium for empty properties. They also have the power to order *compulsory purchases of derelict houses to bring them back into use. The process does however take some time so other approaches such as making modernisation loans more easily available may be necessary.

More radical approaches could see areas of urban decay renovated via large scale regeneration projects. This would involve offering incentives to businesses to move to the area, along with new build houses to replace aging housing stocks along with improvements to local amenities and transport links. In the post EU era the funding for this would need to come from the Government.

As the UK’s leading new homes experts, and with the benefit of our award winning multi brand estate agency network, we have many thousands of buyers registered with us. In fact, last year, 82% of new buyers in the UK registered with our network when buying a new home*. Our very experienced, and knowledgeable, new homes team are always on hand to provide seamless communication links for all new homes sales. (* A report published by Halifax Bank of 335, 750 new buyers who entered the UK property market in 2017).