The UK’s leading Shared Ownership experts

How Much Will Shared Ownership Cost

How much will it cost me?

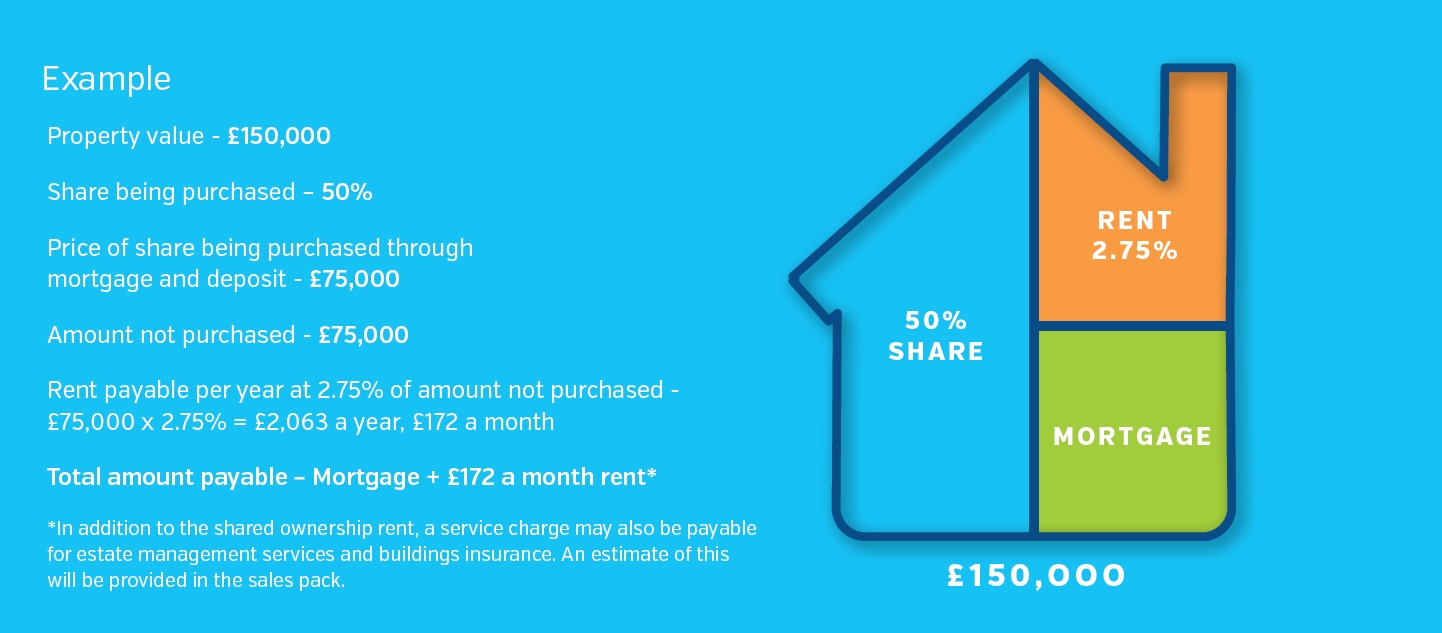

Shared ownership is an increasingly popular housing option that allows buyers to purchase a share of a property, often between 25-75%, and pay rent on the remaining portion. Understanding the key costs associated with shared ownership, such as the deposit, mortgage, rent, and service charges, is crucial for prospective homebuyers to evaluate the financial viability of this scheme.

The main costs will be:

- Deposit - 5-10% of the share you are buying

- Reservation fee

- Mortgage valuation costs

- Legal fee

- General moving costs

Ongoing costs:

- Your mortgage repayments – on the share you own

- Your monthly rental payment – on the share you do not own

- A monthly service charge for the maintenance, landscaping, upkeep of the common areas & building insurance

- Usual household costs such as council tax, water rates, fuels bills, contents insurance, phone /internet costs & fixtures & fittings

- General repairs and maintenance costs (if not covered within the service charges)

- Ground Rent may need to be paid when Staircasing to 100%, especially on apartments

- Cost of buying furnishings

YOUR PROPERTY MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.

RSC and Mortgages First usually charges a fee for mortgage advice. The precise amount of the fee will depend upon your circumstances but will range from £295 to £495 and this will be discussed and agreed with you at the earliest opportunity.